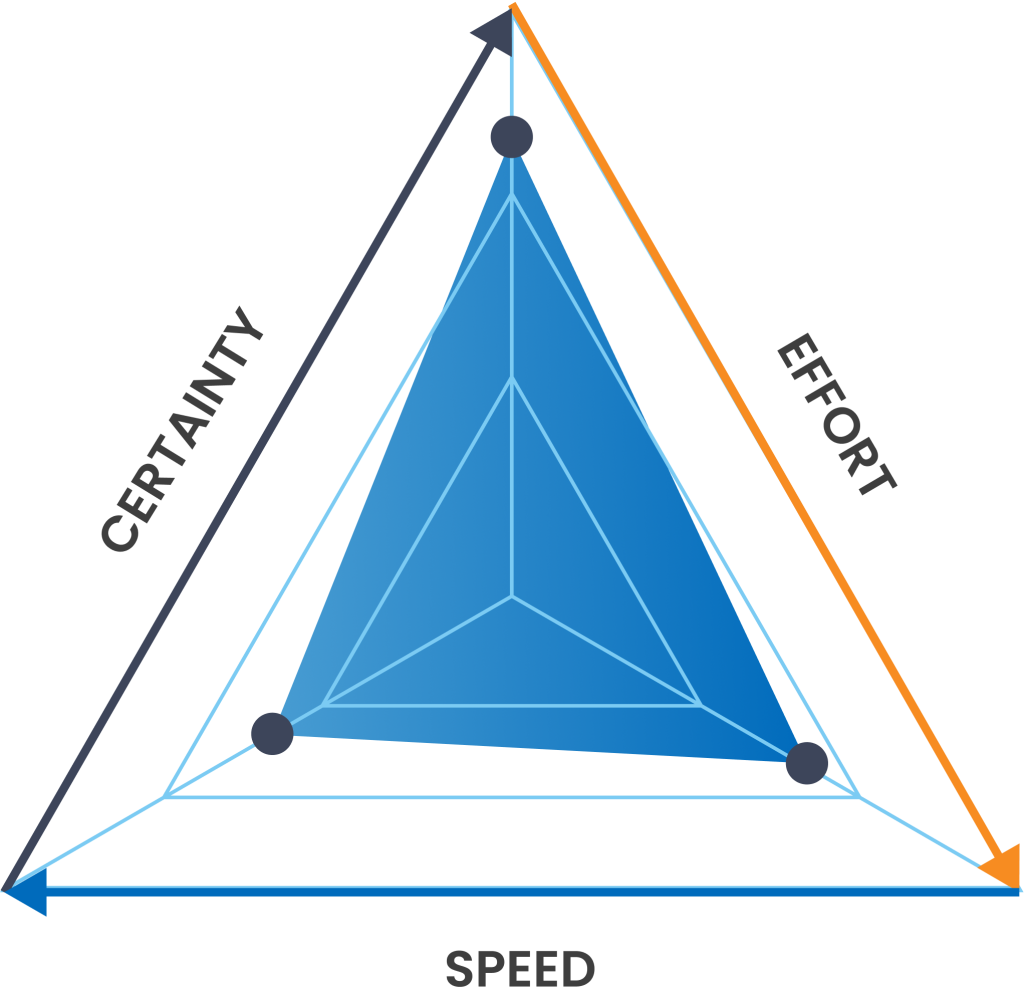

In the world of B2B payment security, businesses face an ‘impossible triangle’, needing a bank account validation that is both fast and certain. However, in reality, gaining higher certainty often requires more time and effort, forcing a trade-off.

With our new Adaptive Payment Security Platform, we transform this challenge. Instead of forcing a compromise, we put you in control. Our platform delivers the fastest possible validation, while giving you the flexibility to increase certainty when you need it most. It’s speed, ease, and certainty, adapted to your business needs.

The Adaptive Payment Security platform includes two core services: Quick Check™ and Knox Verify™

Based on PaymentKnox™ for AP, our platform seamlessly integrates into your existing payment workflows, either as a pure SaaS solution on our portal, through automated file transfer, or a full ERP API integration, providing two levels of validation to match your specific needs.

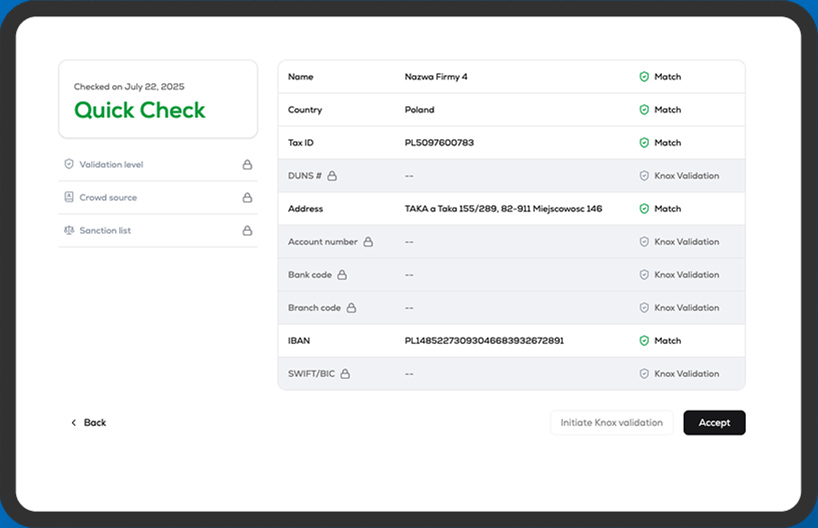

Rapid, Low-Effort Validation When Speed is Key

Quick Check™ provides a fast & smart in-network validation of bank account ownership by cross-referencing nsKnox’s proprietary global database and extensive partner network. This allows you to rapidly verify account information, requiring no registration by the vendor.

For each transaction, you receive a clear validation level and a detailed summary of matched data points, enabling you to assess the risk associated with processing the payment. With greater accuracy than standard automated checks, Quick Check™ delivers the best available results for routine, low-risk scenarios where speed and simplicity matter most.

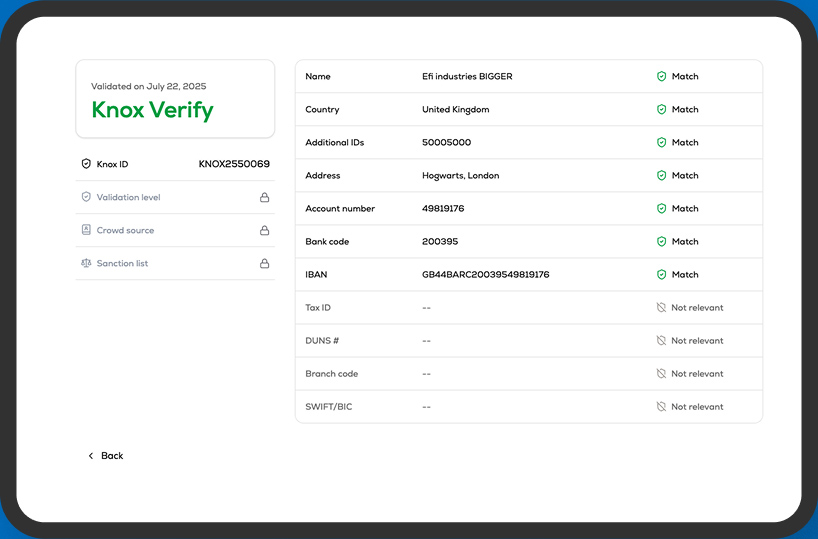

Highest Certainty Using Proprietary Vendor Verification

When Quick Check™ cannot fully validate an account using our in-network capabilities, or when a transaction involves a high-value payment, Knox Verify™ provides an additional layer of defense. It initiates a comprehensive, unique out-of-network mini-payment transaction to confirm account ownership directly with the supplier’s bank account, extracting authoritative banking data, and dynamically adapting to any bank or country, enabling complete global account validation.

Knox Verify™ is designed to prevent fraud even in complex or sensitive situations. The result is a detailed matrix of matched data and a clear validation level, giving your team the confidence to proceed or escalate as needed.

As part of the nsKnox ecosystem, customers can choose to contribute their anonymized Master Vendor File data to our secure community validation network, unlocking access to the collective knowledge of the secure nsKnox community database. Layering Community Insights on top of Quick Check™ results adds an extra layer of defense against fraud.

Where others stop, our validation continues.

nsKnox is the only provider in the Bank Account Validation industry offering total coverage – we can validate any bank account, anywhere in the world, going far beyond the limitations of in-network-only solutions.

Our new Adaptive Payment Security capabilities deliver fast and accurate validations that require no involvement from your suppliers, thereby removing friction and delays. This is all underpinned by our patented Cooperative Cyber Security™ (CCS) technology, which distributes data across a decentralized network, making it mathematically impossible for fraudsters to compromise your critical payment information.

Download the one-pager or contact us to see how Adaptive Payment Security™ can work for you.

nsKnox is a fintech-security company, enabling corporations and banks to prevent fraud and ensure compliance in B2B Payments. Founded and led by Alon Cohen, Founder & former CEO of CyberArk (NASDAQ: CYBR), nsKnox solutions help organizations avoid significant financial losses, heavy fines, and reputational damage.

Leveraging its patented Cooperative Cyber Security™ (CCS) and groundbreaking Bank Account Certificate™ technology, nsKnox’s solutions detect and prevent finance & ops infrastructure attacks, social engineering, business email compromise (BEC), insider-fraud and other Advanced Persistent Fraud attacks.