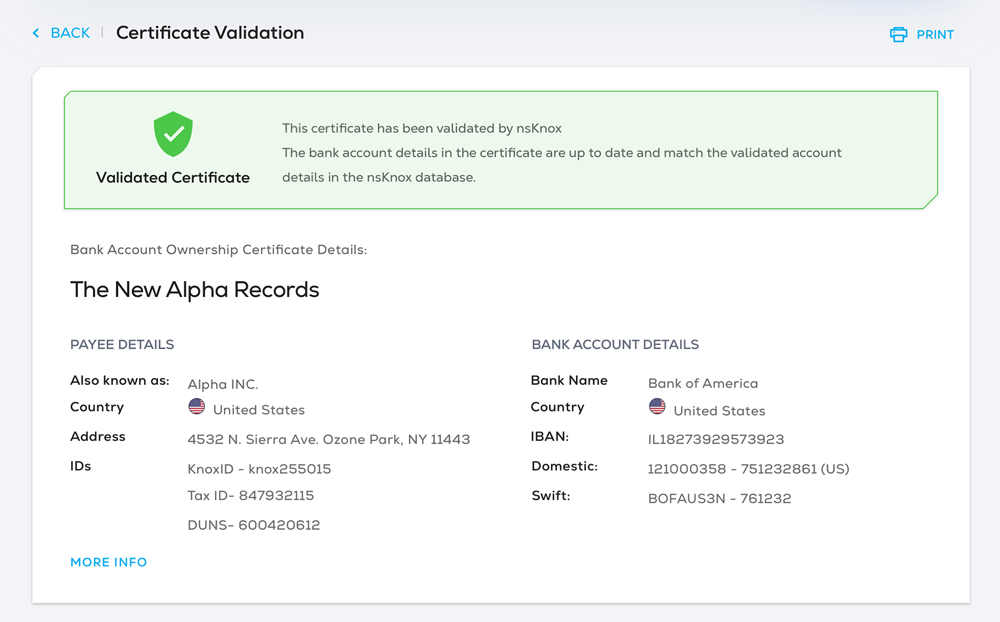

Bank Account Certificates

the only fraud-proof approach to validating and sharing bank account details

Outdated, manual processes for validating and sharing bank account details are at the heart of cyberfraud manipulations. That’s because these processes are very vulnerable, leaving both the paying entity and receiving organization exposed to cybercrime.

nsKnox is a fintech-security company, enabling corporations and banks to prevent fraud and ensure compliance in B2B Payments. Founded and led by Alon Cohen, Founder & former CEO of CyberArk (NASDAQ: CYBR), nsKnox solutions help organizations avoid significant financial losses, heavy fines, and reputational damage.

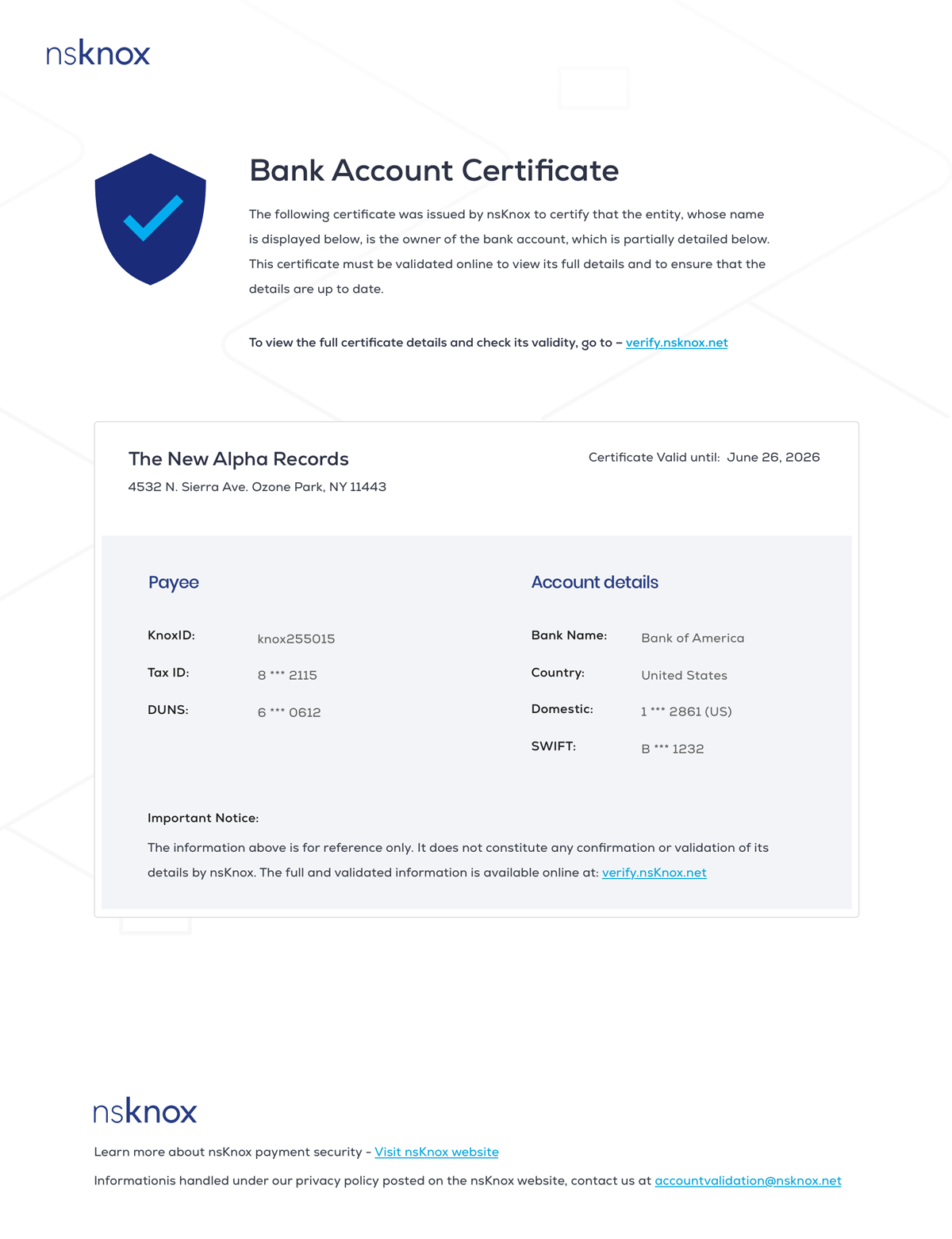

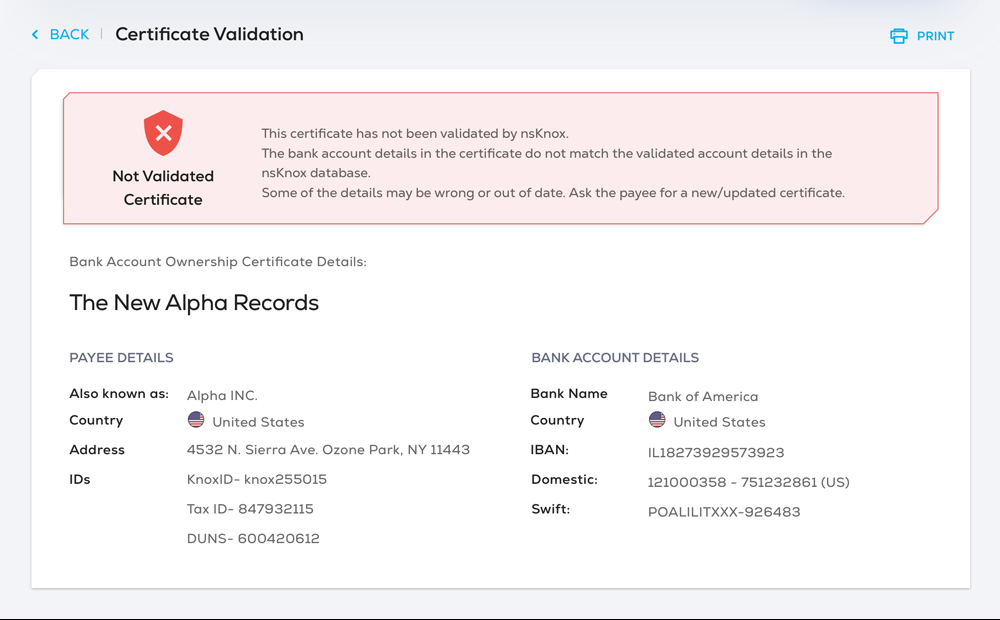

Leveraging its patented Cooperative Cyber Security™ (CCS) and groundbreaking Bank Account Certificate™ technology, nsKnox’s solutions detect and prevent finance & ops infrastructure attacks, social engineering, business email compromise (BEC), insider-fraud and other Advanced Persistent Fraud attacks.