Solutions

Payment security & compliance for banks and corporate clients

Three levels of fraud-proof protection that goes far beyond signatory rights

Organizations are under a constant threat of losing millions of dollars to payment fraud and are looking to their bank for solutions.

Banks themselves are at risk for failing to detect and prevent fraudulent transactions.

In today’s world, where fraudsters have become exceedingly adept at leveraging sophisticated technologies, such as AI and deep fake to hack an organization’s communications and business systems so they can execute fraudulent payments, cybercriminals are able to compromise signatory rights, so no bank can afford to rely solely on this measure when authorizing B2B payments.

PaymentKnox™ for Banks is a secured SaaS platform that applies three layers of robust protection that goes far beyond signatory rights.

It is a payment security service that protects both the corporate client and the bank, by ensuring that every beneficiary paid by the bank is:

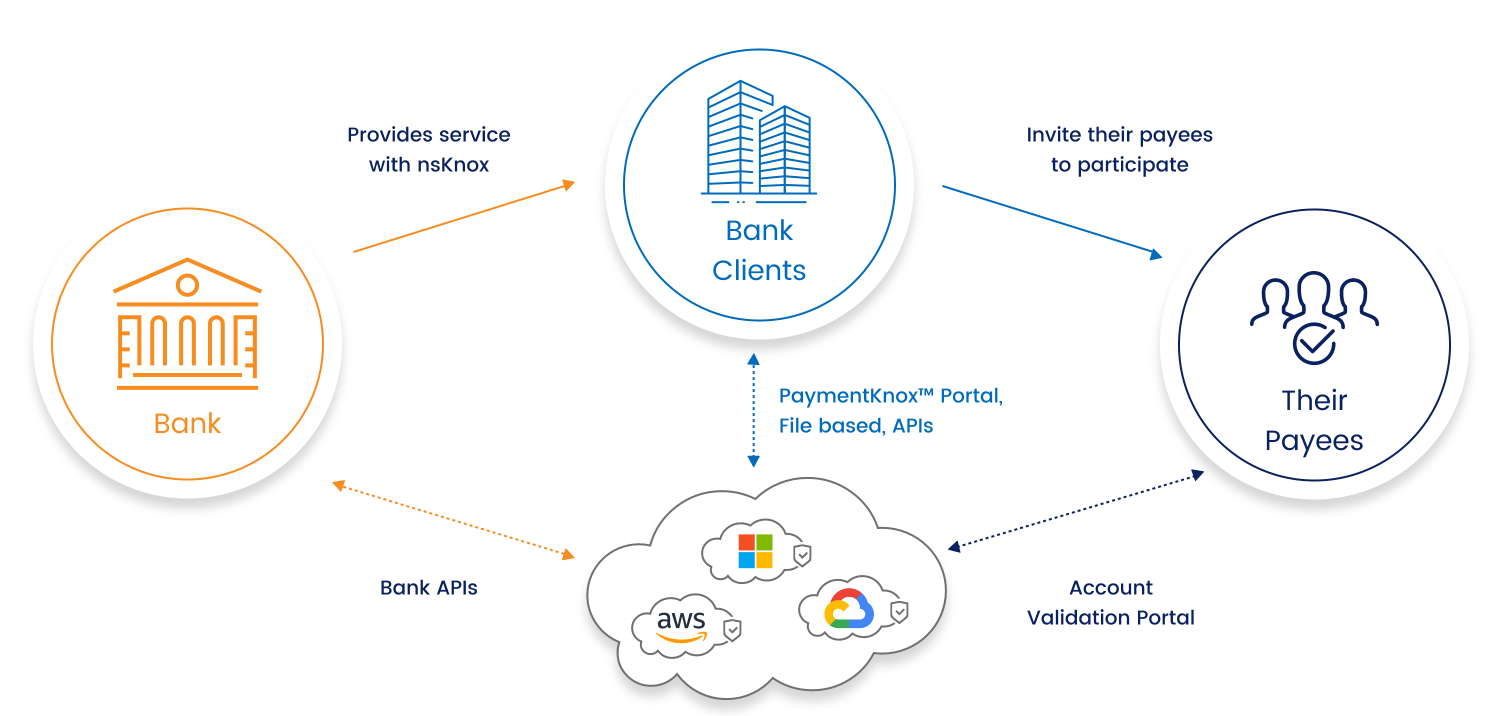

The banks and its corporate clients connect to the PaymentKnox™ platform through a variety of interfaces, including a secured portal, using files or an API for accelerated time to protection

nsKnox is a fintech-security company, enabling corporations and banks to prevent fraud and ensure compliance in B2B Payments. Founded and led by Alon Cohen, Founder & former CEO of CyberArk (NASDAQ: CYBR), nsKnox solutions help organizations avoid significant financial losses, heavy fines, and reputational damage.

Leveraging its patented Cooperative Cyber Security™ (CCS) and groundbreaking Bank Account Certificate™ technology, nsKnox’s solutions detect and prevent finance & ops infrastructure attacks, social engineering, business email compromise (BEC), insider-fraud and other Advanced Persistent Fraud attacks.