PaymentKnox for AR

automated & secure cyberfraud prevention

leverage a technology-driven process to empower customers to validate your bank account details prior to making payments and prevent fraud

Today’s cybercriminals are targeting B2B payments more than ever, with four out of five companies falling victim, according to the Association for Financial Professionals (AFP).

Your customers and business partners may also fall victim to payment fraud and unwittingly transfer funds intended for you to fraudulent accounts instead. The result is immediate damage to your cash flow and income.

To make matters worse, when fraudulent activity originates from within your organization – for example, as a result of a breached email account or acts of a bad insider – You may be held accountable for the loss rather than the paying customer. Reputational damage is added to the mix as well.

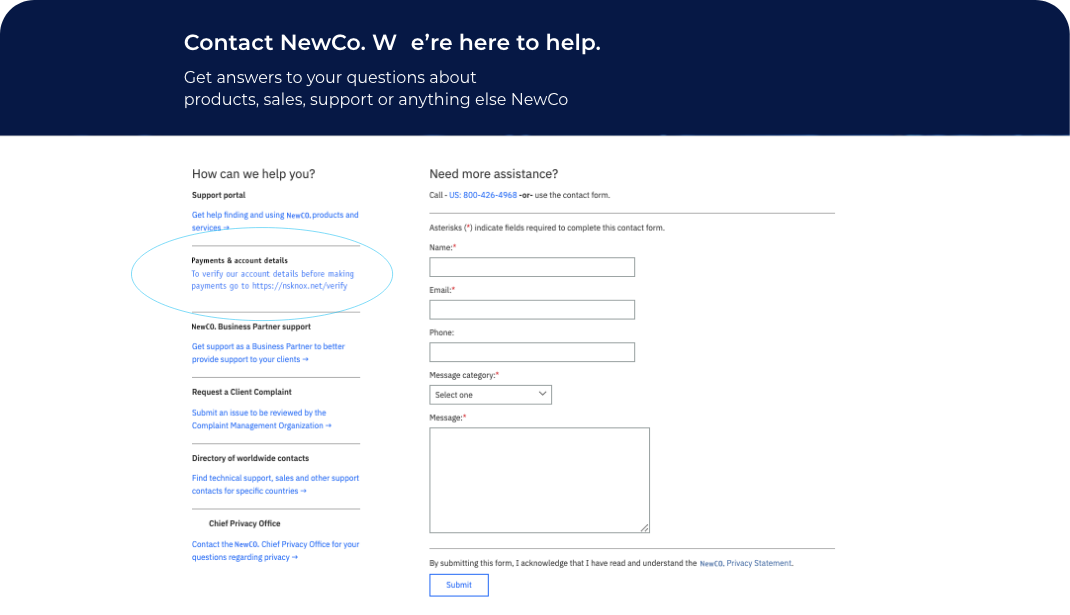

Bank Account Certificates (BAC) from nsKnox introduce a reliable and fraud-proof approach to sharing and verifying banking details.

BAC replaces outdated bank letters and void checks with a secure and verifiable document that can confirm the ownership of bank accounts for any account, anywhere in the world.

The certificate has all the relevant information needed to receive or send payments. It allows you to provide a free-of-charge service to your business partners to securely share, verify, store and protect bank account details and additional documents they may require (such as a bank letter or a W9 form).

It protects both paying and receiving entities and prevents payment fraud.

nsKnox is a fintech-security company, enabling corporations and banks to prevent fraud and ensure compliance in B2B Payments. Founded and led by Alon Cohen, Founder & former CEO of CyberArk (NASDAQ: CYBR), nsKnox solutions help organizations avoid significant financial losses, heavy fines, and reputational damage.

Leveraging its patented Cooperative Cyber Security™ (CCS) and groundbreaking Bank Account Certificate™ technology, nsKnox’s solutions detect and prevent finance & ops infrastructure attacks, social engineering, business email compromise (BEC), insider-fraud and other Advanced Persistent Fraud attacks.